The Real Estate Market Facts quarterly report has shown an impact on prices from the COVID-19 pandemic, but it has not been as dramatic as some have predicted.

“In the March edition I flagged that June quarter 2020 will reflect the impacts of the start of the COVID-19 pandemic on both the sales and rental markets,” said REIA president Adrian Kelly.

“Whilst there has been an impact on prices it is relatively modest and has certainly not been the doomsday prophesies some commentators expected.

“Nor has the impact been uniform across Australia with local market conditions varying, resulting in a range of outcomes.”

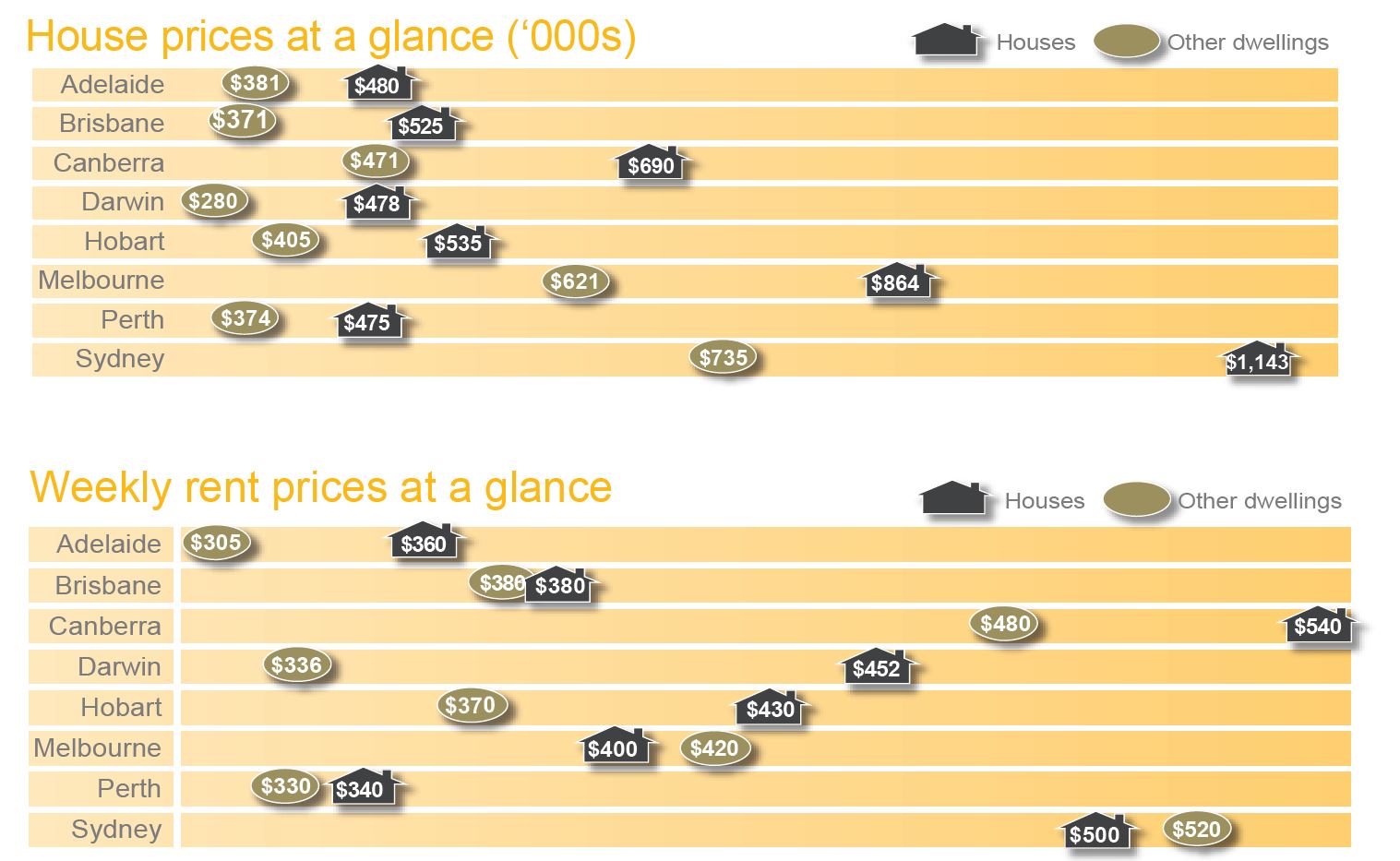

This REMF edition shows in the June quarter 2020 the weighted average median price for houses for the eight capital cities decreased by 2.2% to $770,359, with only Darwin having an increase and Adelaide remaining stable.

This is the first quarterly decrease since March 2019. For the year the weighted average median price for houses for the eight capital cities increased by 5.9%.

The weighted average median price for other dwellings also decreased by 1.9% to $592,415 over the quarter, with only Adelaide and Hobart recording increases.

For the year the weighted average median price for houses for the eight capital cities increased by 4.8%.

Over the quarter, the median rent for three-bedroom houses decreased in all capital cities except for Canberra, where there was a marginal increase, and Sydney where the rent remained stable.

The decrease in median rents for 3-bedroom houses, over the quarter, was 1.6%. There is a consistent pattern for June quarter median rents to decline and the 2020 decline cannot be attributed entirely to the impact of COVID-19. Indeed the quarterly decline is below the June 2018 decline of 2.5%.

The median rent for two-bedroom other dwellings decreased in all capital cities except Darwin, which had a 1.7% increase. The largest decline was in Melbourne, and at 8.7% it's the largest decline in the past 10 years.

The weighted average vacancy rate for the eight capital cities decreased to 3.0% during the June quarter, which shows a loosening in the market compared to last quarter.

“A factor contributing to the market stability is the decline in the number of listings for sale,” said Mr Kelly.

“In all capital cities except Perth the number of houses and other dwellings for sale declined compared to the June quarter 2019.

“The biggest declines were in Hobart where the number of houses for sale declined by 33% and the number of other dwellings by 26%.

“The market is holding up better than many expected with the Government’s initiatives of JobKeeper and JobSeeker as well as the banks loan deferrals playing their part in stabilising the situation.

“With extensions to these having been announced we expect continued stability in the market,” concluded Mr Kelly.

To download the Media Release Click Here.

To View the Report Click Here.

The Real Estate Institute of Australia (REIA) is the national professional association for real estate agents in Australia.

For further information or to speak with REIA President Adrian Kelly please contact Samantha Elley via [email protected] or 0413 986 068.